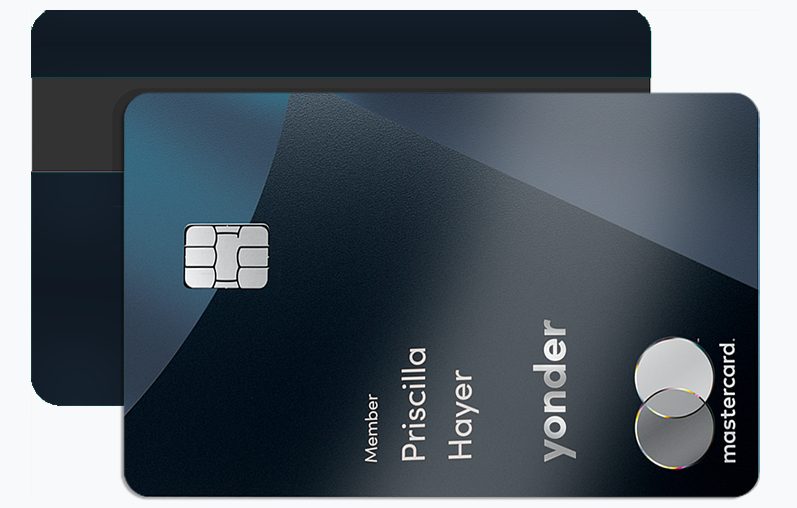

YONDER

NO ANNUAL FEE GENEROUS REWARDSThe Yonder Credit Card is quickly gaining attention for its unique features and flexible rewards program. Designed to cater to modern consumers who want more than just a way to make payments, the Yonder Credit Card offers an innovative approach to managing finances. With a sleek design and a range of benefits, it promises to help you earn rewards while enjoying greater financial flexibility. In this article, we’ll explore the key advantages, drawbacks, and how you can apply for the Yonder Credit Card.

Key Advantages of the Yonder Credit Card

No Interest or Annual Fees

One of the standout features of the Yonder Credit Card is its lack of interest and annual fees. While many credit cards charge high interest rates or an annual fee to enjoy their perks, Yonder offers a refreshing approach by allowing cardholders to avoid these costs entirely. This makes it an attractive choice for those who want to avoid extra charges and keep their expenses in check.

Generous Rewards on Everyday Purchases

Yonder is all about rewarding its users for everyday spending. Cardholders can earn a generous percentage of cash back on purchases in various categories, including dining, travel, and groceries. With the ability to earn rewards on common expenses, the Yonder Credit Card helps maximize your financial return for simply managing your regular purchases.

Easy-to-Use Mobile App for Tracking and Management

The Yonder Credit Card comes with a user-friendly mobile app that lets you track your spending, redeem rewards, and manage your account in real-time. The app provides a seamless experience for cardholders who want to stay on top of their finances while enjoying the convenience of mobile access. From budgeting tools to instant notifications, this app adds significant value to your financial management.

Disadvantages of the Yonder Credit Card

Limited Acceptance

Although Yonder is gaining popularity, it still faces limitations when it comes to acceptance at certain merchants. Not all retailers or service providers accept the Yonder Credit Card, especially when compared to more widely used cards like Visa or MasterCard. This may be an issue for those who want the convenience of using their card everywhere.

High Penalties for Late Payments

While Yonder boasts no interest fees, cardholders may face steep penalties for late payments. Missing a payment or paying after the due date can result in significant fees, which can quickly offset the benefits of using the card. It’s important to stay diligent with payment deadlines to avoid unnecessary charges.

Want to Learn More About the Yonder Credit Card?

If you’re interested in exploring the full range of benefits and details about the Yonder Credit Card, continue reading to discover how you can apply for your own card today. With no interest fees, excellent rewards, and a simple application process, it could be the perfect addition to your financial toolkit.

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>  Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>

Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>  M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>

M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>