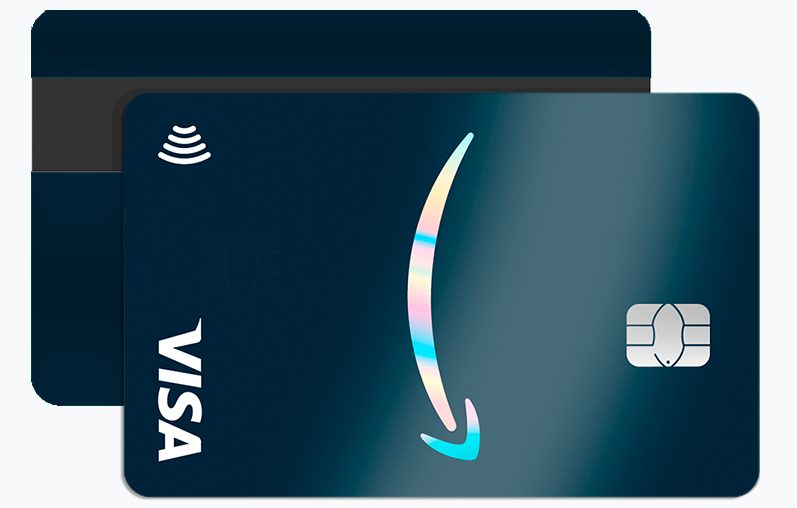

The Amazon Barclaycard Visa offers cardholders a variety of benefits, making it one of the most popular credit cards for Amazon shoppers. With cashback rewards, special financing options, and exclusive Amazon perks, this card is designed to maximize your shopping experience. In this guide, we’ll delve deeper into the features of the Amazon Barclaycard Visa, explain the requirements for applying, and provide a step-by-step process for getting started.

Positive Aspects of the Amazon Barclaycard Visa

The Amazon Barclaycard Visa is much more than just a credit card; it’s a tool that enhances your online and in-store shopping experience. Let’s take a closer look at some of the most compelling reasons to consider applying for this card.

Unlimited 3% Cashback on Amazon Purchases

Cardholders earn 3% cashback on every Amazon purchase, which is one of the highest reward rates available for online shopping. If you frequently buy products from Amazon, this can add up to significant savings over time. Whether you’re buying small items or larger purchases like electronics and home appliances, this cashback can be redeemed to lower your balance or even pay for new purchases.

2% Cashback at Restaurants, Gas Stations, and Drugstores

In addition to the 3% cashback on Amazon purchases, the Amazon Barclaycard Visa offers 2% cashback on purchases at restaurants, gas stations, and drugstores. This makes it an excellent choice for cardholders who want to earn rewards on everyday expenses, adding further value to the card.

1% Cashback on All Other Purchases

For purchases that don’t fall into the above categories, you still earn 1% cashback. This ensures that every purchase you make, whether it’s at your local store or online, brings in some reward. The Amazon Barclaycard Visa is designed to make all of your spending work for you, no matter where you use it.

No Annual Fee

One of the key advantages of the Amazon Barclaycard Visa is that it comes with no annual fee. This makes it accessible to a wide range of consumers without the burden of extra costs. With no annual fee, you can enjoy all the benefits without worrying about a membership cost eating into your rewards.

Access to Exclusive Amazon Deals and Promotions

Cardholders gain access to exclusive Amazon promotions, such as early access to Lightning Deals, special discounts, and sales events. These perks can help you save even more on your Amazon shopping, ensuring that you’re always ahead of the game when it comes to securing the best deals.

Flexible Payment Options with Special Financing

The Amazon Barclaycard Visa also offers flexible financing options for larger purchases. If you buy an item over a certain price, you may be eligible for 6 to 12 months of special financing with 0% interest. This makes it easier to manage larger purchases without worrying about high-interest charges, especially when the card is used for qualifying Amazon purchases.

Prerequisites for Applying for the Amazon Barclaycard Visa

Before you apply for the Amazon Barclaycard Visa, it’s important to know if you meet the basic requirements. While the application process is relatively straightforward, there are a few prerequisites to consider.

- Good Credit Score

The Amazon Barclaycard Visa is typically available to individuals with a good to excellent credit score. A score of at least 670 is generally considered acceptable, though a higher score will increase your chances of approval and may help you secure better terms, such as a lower APR. - U.S. Residency

You must be a U.S. resident to apply for the Amazon Barclaycard Visa. This is a requirement for most credit cards issued by U.S.-based banks, including the Amazon Barclaycard. - Income Verification

As part of the application process, you’ll need to provide information about your income. This is standard for credit card applications, as it helps the lender assess your ability to repay the balance. There’s no specific minimum income requirement, but having a stable income will increase your chances of approval. - No Recent Bankruptcies

If you’ve had a bankruptcy in the past, it may be more challenging to get approved for the Amazon Barclaycard Visa. Typically, applicants need to have been free from bankruptcy for at least a few years. - Valid Social Security Number

You will need a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to apply for the Amazon Barclaycard Visa. This is required for identity verification and credit assessment purposes.

Frequently Asked Questions (FAQ)

1. Does the Amazon Barclaycard Visa offer a sign-up bonus?

Yes! The Amazon Barclaycard Visa offers a sign-up bonus, where you can earn a substantial amount of bonus cashback after making a qualifying purchase within the first few months of account opening. Be sure to check the current offer on the application page.

2. How do I redeem my cashback rewards?

You can redeem your cashback rewards through your Amazon account or as a statement credit. The redemption process is simple and flexible, allowing you to use your rewards for future Amazon purchases or reduce your credit card balance.

3. Is there an introductory APR for new purchases?

Yes, new cardholders can enjoy an introductory 0% APR on purchases for a limited time (usually 6 to 12 months). After the promotional period ends, the APR reverts to the standard rate.

4. Can I use my Amazon Barclaycard Visa for purchases outside of Amazon?

Absolutely! The Amazon Barclaycard Visa can be used for purchases at any location that accepts Visa cards. You’ll earn cashback on your purchases wherever you shop, not just on Amazon.

Step-by-Step Guide to Applying for the Amazon Barclaycard Visa

Applying for the Amazon Barclaycard Visa is easy and can be done in just a few simple steps.

Step 1: Visit the Official Amazon Barclaycard Application Page

Head over to the official Amazon Barclaycard Visa application page. This can be found on Amazon’s website or by searching for “Amazon Barclaycard Visa application.”

Step 2: Fill Out Your Personal Information

Enter your personal information, including your name, address, Social Security Number, and date of birth. You’ll also need to provide details about your income and employment.

Step 3: Review the Terms and Conditions

Take a moment to review the terms and conditions of the card, including the APR, fees, rewards structure, and any introductory offers. It’s important to understand the terms before submitting your application.

Step 4: Submit Your Application

Once you’ve reviewed all the details, click “Submit” to send in your application. You’ll receive a response quickly—either an approval or a request for more information.

Step 5: Activate Your Card

If you’re approved, you’ll receive your Amazon Barclaycard Visa in the mail. Activate it as soon as you receive it, and start enjoying all the benefits!

Applying for the Amazon Barclaycard Visa can be a great move for frequent Amazon shoppers. With cashback, flexible financing, and exclusive perks, it’s a card designed to enhance your shopping experience.

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>  Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>

Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>  M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>

M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>