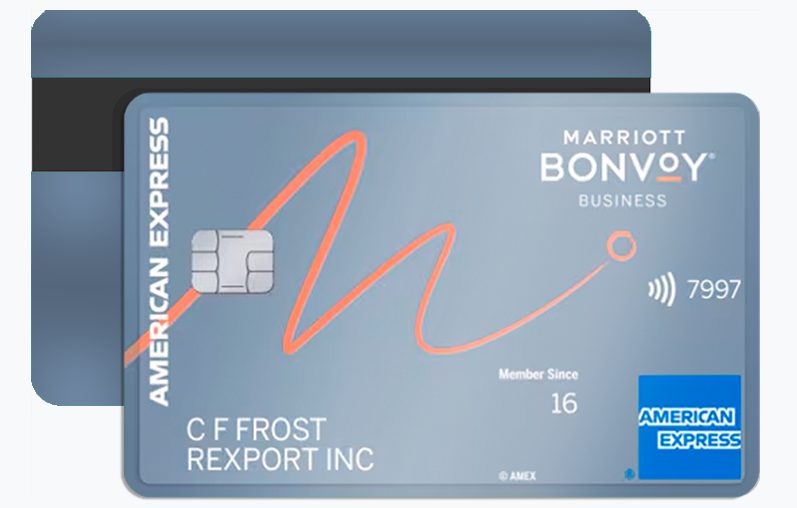

MARRIOT BONVOY AMERICAN EXPRESS CARD

EARN POINTS ON EVERY PURCHASE SILVER ELITE STATUSFor avid travelers and Marriott enthusiasts, the Marriott Bonvoy American Express Card offers an exciting opportunity to earn valuable rewards while enjoying premium travel benefits. Whether you’re looking to earn points for future hotel stays, enjoy special perks, or make the most of your everyday spending, this card is a top choice for those who want to elevate their travel experience. In this article, we will explore the key benefits and potential drawbacks of the Marriott Bonvoy American Express Card, along with a guide on how to apply.

Top 3 Benefits of the Marriott Bonvoy American Express Card

The Marriott Bonvoy American Express Card offers several valuable features designed to enhance your travel experience:

Earn Points for Every Purchase

One of the standout features of the Marriott Bonvoy American Express Card is its generous rewards program. Cardholders can earn Marriott Bonvoy points on every purchase, with bonus points for spending at Marriott properties, including hotels, resorts, and vacation rentals. These points can be redeemed for free nights, room upgrades, and more, making it an excellent way to save on future stays.

Automatic Silver Elite Status

With this card, you’ll receive complimentary Silver Elite status in the Marriott Bonvoy loyalty program. This status offers perks like priority late check-out, bonus points on eligible stays, and more. As you continue to use the card, you can even achieve higher levels of status, unlocking additional benefits and rewards for your stays.

Access to Travel Protections and Insurance

The Marriott Bonvoy American Express Card also provides a range of travel protections, including purchase protection, travel accident insurance, and trip delay reimbursement. These benefits offer peace of mind while traveling, ensuring that you’re covered in case of unexpected events, such as delays, cancellations, or lost luggage.

Drawbacks of the Marriott Bonvoy American Express Card

While the Marriott Bonvoy American Express Card comes with many advantages, there are a few potential drawbacks to consider:

High Annual Fee

The Marriott Bonvoy American Express Card comes with an annual fee, which might be a downside for some users. While the card offers great rewards, you’ll need to weigh the cost of the annual fee against the potential benefits, especially if you don’t travel frequently enough to fully maximize the rewards.

Limited Redemption Options for Non-Travel Purchases

Although the Marriott Bonvoy points are valuable for hotel stays and travel-related expenses, the redemption options for non-travel purchases are somewhat limited. This can be a downside for those who don’t travel often or prefer more flexibility in how they use their points.

Want to Learn More About the Marriott Bonvoy American Express Card?

If you’re considering the Marriott Bonvoy American Express Card and want to know how it can fit into your travel plans or how to apply for it, continue reading for more detailed information. Find out how to make the most of your rewards and start enjoying exclusive travel benefits today!

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>  Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>

Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>  M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>

M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>