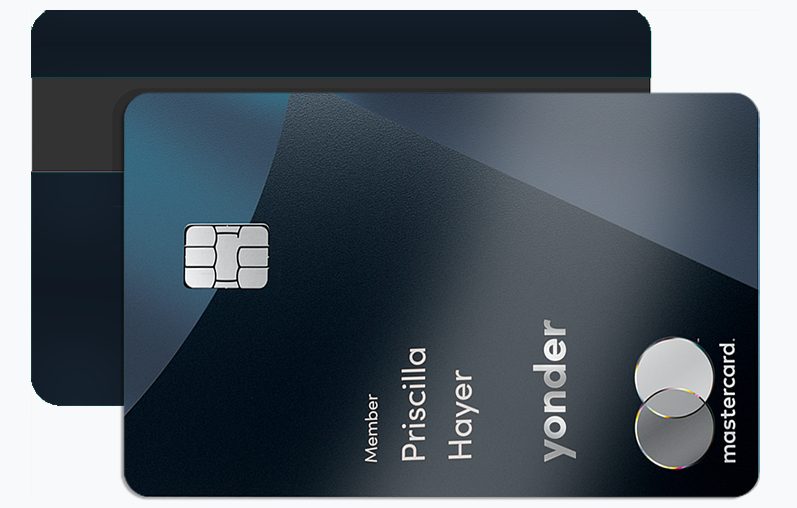

The Yonder Credit Card is reshaping the way consumers think about credit cards. Unlike traditional credit cards, it offers innovative features designed to enhance financial flexibility and maximize rewards for everyday purchases. Whether you are looking for a card with no hidden fees, exceptional rewards, or enhanced mobile management, the Yonder Credit Card has something to offer. In this comprehensive guide, we’ll explore additional advantages of the Yonder Credit Card, the requirements for applying, and provide a detailed step-by-step application process to help you get started today.

Additional Benefits of the Yonder Credit Card

No Foreign Transaction Fees

Travelers will appreciate that the Yonder Credit Card comes with no foreign transaction fees. This makes it a great option for anyone who frequently travels abroad. With many credit cards imposing a 2-3% fee on foreign transactions, Yonder’s fee-free structure makes international purchases much more affordable, allowing you to save on your spending while abroad.

Personalized Spending Insights

Yonder provides cardholders with personalized spending insights through its mobile app. This feature analyzes your spending patterns and offers tailored recommendations to help you save money, budget better, and even optimize your rewards. Whether you’re trying to curb unnecessary expenses or increase your rewards earnings, this app tool helps you take control of your financial habits.

Access to Exclusive Discounts and Offers

As a Yonder Credit Card holder, you gain access to exclusive discounts and offers at select retailers, restaurants, and online stores. These exclusive deals are constantly updated, meaning that cardholders can continually take advantage of new savings opportunities. Whether you’re shopping for fashion, gadgets, or food, you’ll find that Yonder gives you an edge in saving money on your favorite brands.

24/7 Customer Support

Yonder goes above and beyond in providing excellent customer service. Cardholders can access 24/7 support through the Yonder mobile app or by phone. Whether you have questions about your account, need assistance with a transaction, or require emergency card replacement services, the customer support team is always available to help. This level of accessibility ensures that you never feel alone when managing your card.

Cashback Rewards on All Purchases

In addition to earning rewards in specific categories like dining and travel, Yonder also offers cashback rewards on all eligible purchases. This means that regardless of what you buy, you’ll always earn something back, making it easy to accumulate points for future redemption. This flat-rate cashback structure is especially appealing to people who want to earn rewards on everyday expenses without the need to track rotating categories.

Pre-Requisites for Applying for the Yonder Credit Card

Before applying for the Yonder Credit Card, it’s essential to ensure you meet the eligibility criteria. Understanding the basic requirements will help you decide whether this card is a good fit for you.

- Minimum Credit Score

While Yonder does not specify an exact credit score requirement, applicants generally need to have a good credit score of at least 670 or higher to be approved. If your credit score is lower, consider checking your credit report and working to improve your score before applying to increase your chances of approval. - Proof of Income

Yonder may require applicants to provide proof of income as part of the application process. This ensures that you have the financial ability to manage and repay any purchases made on the card. Common documents include recent pay stubs, tax returns, or bank statements. Having these documents ready can streamline your application. - Age and Residency Requirements

To apply for the Yonder Credit Card, you must be at least 18 years old (or 21 years old in certain regions depending on local regulations). Additionally, applicants must be a resident of the country in which they are applying. Non-residents or those without a stable address may have difficulty qualifying. - No Recent Bankruptcy or Delinquency

If you’ve recently filed for bankruptcy or have accounts in serious delinquency, your application may be denied. Yonder looks for individuals who have a stable credit history and demonstrate responsibility in managing their finances. - Social Security Number (SSN) or Taxpayer Identification Number (TIN)

You will also need a valid SSN or TIN to apply for the Yonder Credit Card. This helps Yonder verify your identity and assess your creditworthiness.

Frequently Asked Questions (FAQ)

1. What are the interest rates for the Yonder Credit Card?

The Yonder Credit Card does not charge interest, which is a key benefit for those looking to avoid paying extra on purchases. This fee structure helps cardholders save money and manage payments with greater flexibility.

2. Can I earn rewards on all purchases with the Yonder Credit Card?

Yes, you earn rewards on all eligible purchases, including non-category purchases. This is one of the major advantages of the Yonder Credit Card, as it helps you accumulate points quickly regardless of where you spend.

3. Is the Yonder Credit Card accepted internationally?

Yes, the Yonder Credit Card is accepted internationally at millions of locations, as it operates on a widely recognized payment network. Plus, there are no foreign transaction fees, which makes it a fantastic option for travelers.

4. How can I redeem my rewards?

You can redeem your rewards through the Yonder mobile app, where you can convert points into cashback, travel credits, or other available redemption options. The process is simple and allows you to use your rewards however you see fit.

Step-by-Step Guide to Apply for the Yonder Credit Card

Applying for the Yonder Credit Card is simple and straightforward. Follow these steps to get started:

- Check Your Eligibility

Review the eligibility criteria to make sure you meet the basic requirements, including credit score, income, and residency status. - Gather the Required Documents

Before applying, gather necessary documentation such as proof of income, identification, and your Social Security Number (SSN) or Taxpayer Identification Number (TIN). - Visit the Yonder Website or App

Go to the official Yonder website or download the Yonder app to begin the application process. You will find an easy-to-navigate form where you can enter your personal and financial details. - Fill Out the Application Form

Complete the application form by providing accurate information, including your full name, contact details, employment information, and income. - Submit Your Application

Once you’ve filled out the form, submit your application for review. Yonder will process your details, and you may receive an instant approval decision. - Wait for Your Card

If approved, you will receive your Yonder Credit Card in the mail. Once you activate your card, you can start earning rewards and enjoying all the benefits the card has to offer.

With its wide array of benefits, no interest fees, and easy-to-use app, the Yonder Credit Card is an excellent choice for anyone looking to streamline their financial management. Whether you’re a frequent traveler, a rewards enthusiast, or simply seeking a no-fuss credit card, Yonder offers flexibility and value for every cardholder. Follow the steps in this guide to apply for your Yonder Credit Card and unlock a new world of financial possibilities today!

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>

Lloyds Bank Cashback Credit Card <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Earn Cash Back on Everyday Spending </p>  Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>

Santander Everyday No Balance Transfer Fee Credit Card: Comprehensive Guide <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Unlock Savings and Simplicity with the Santander Everyday Credit Card </p>  M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>

M&S Bank Credit Card Transfer Plus Offer Mastercard: Everything You Need to Know <p class='sec-title' style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Maximize Your Financial Benefits </p>